child tax credit 2021 dates irs

Advance Child Tax Credit. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Child Tax Credit 2021 Changes Grass Roots Taxes

The American Rescue Plan Act ARPA of 2021 expanded the Child Tax Credit CTC for tax year 2021 only.

. The Internal Revenue Service will issue information letters to Advance Child Tax Credit recipients starting in December and to recipients of the third round of the Economic Impact. Well tell you how many payments are left how to unenroll and how to use the portals to update your info. Child Tax Credit FAQs for Your 2021 Tax Return Parents have lots of questions about how to report the child tax credit and last years monthly payments on their tax return and we have answers.

Child Tax Credit Payment Dates 2022 LAM BLOGER from ess3usuariosepsinfo. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022.

The next advance check comes Sept. To reconcile advance payments on your 2021 return. If your child is not a qualifying child for the Child Tax Credit you may be able to claim the 500 Credit for Other Dependents for that child when you file 2021 your tax return.

The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. The individual is the taxpayers son daughter stepchild eligible foster child brother sister stepbrother stepsister half-brother or half-sister or a descendant of any of them for example a grandchild niece or nephew.

Businesses and Self Employed. States Government English Español中文 한국어РусскийTiếng ViệtKreyòl ayisyen Information Menu Help News Charities Nonprofits Tax Pros Search Toggle search Help Menu Mobile Help Menu Toggle menu Main navigation mobile File Overview INFORMATION FOR Individuals Business Self Employed. IRSgovchildtaxcredit2021 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above.

A permanent expansion of the earned income credit from 18 to 20 of the federal credit. Property tax rebates for homeowners earning less than 250000 -- or 500000 if filing jointly -- will be. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per. The IRSs 2022 tax filing season. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. It also provided monthly payments from July of 2021 to December of 2021. These FAQs were released to the public in Fact Sheet 2022-28 PDF April 27 2022.

The 500 nonrefundable Credit for Other Dependents amount has not changed. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of your 2021 income using the Child Tax Credit Update Portal CTC UP. The IRSs 2022 tax filing season has begun.

Enter your information on Schedule 8812 Form. An increase in the maximum credit that households can claim up to 3600 per child age. Earned Income Tax Credit.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may. The final advance child tax credit payment for 2021 is set to hit bank accounts on dec. This first batch of advance monthly payments worth roughly 15 billion.

Get your advance payments total and number of qualifying children in your online account. IR-2021-153 July 15 2021. These Child Tax Credit frequently asked questions focus.

The tax agency started accepting individual tax returns for the 2021. The Michigan mother of three including a son with autism used the money to pay. Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in monthly payments during the second half of 2021.

Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. More payments will go out in the new year according to the internal revenue service. Families will receive the entire 2021 Child Tax Credit that they are eligible for when they file in.

3600 for children ages 5 and under at the end of 2021. For more information about the Credit for Other Dependents see. Advance payments of the 2021 Child Tax Credit will be made regularly from July through December to eligible taxpayers who have a main home in the United States for more than half the year.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Payments begin July 15 and will be sent monthly through December 15 without any further action required. For tax year 2021 a qualifying child is an individual who did not turn 18 before January 1 2022 and who satisfies the following conditions.

The total of the advance payments will be up to 50 percent of the Child Tax Credit. 3000 for children ages 6 through 17 at the end of 2021. IR-2021-218 November 9 2021.

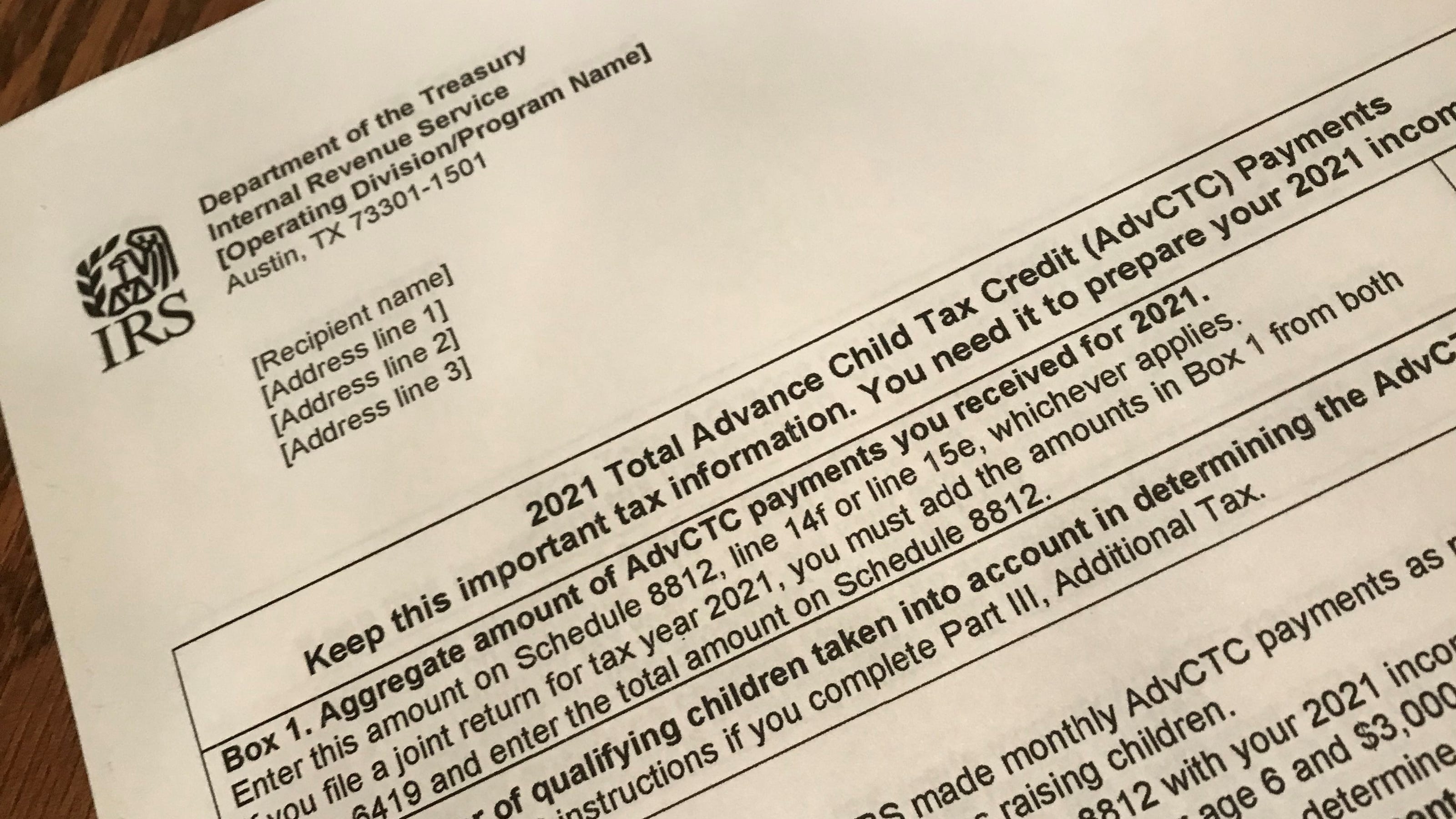

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Child Tax Credit Payments Start July 15

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

2021 Child Tax Credit What It Is How Much Who Qualifies Ally